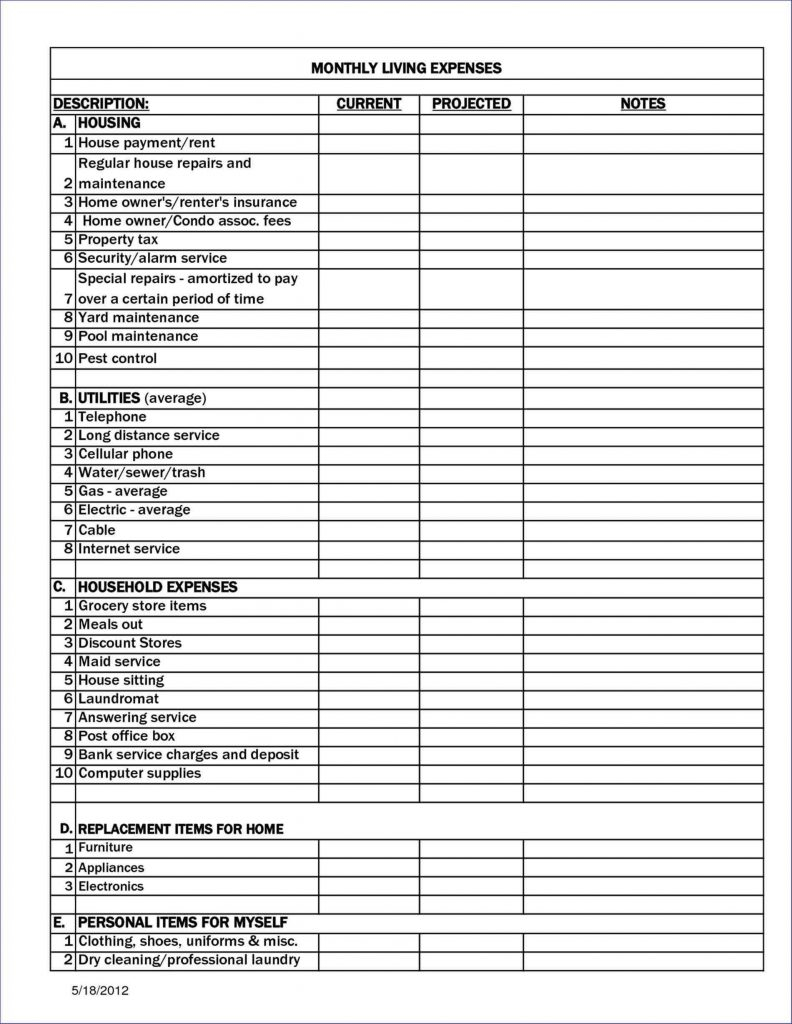

There are, of course, other expenses that I haven’t factored in here such as lawn maintenance – either paying someone to cut your grass, or buying and maintaining a mower and associated equipment so you can do it yourself – utilities, HOA fees, etc.

Looking ahead, however, I’m expecting to have to replace the roof sometime in the next ten or so years. In the six years we’ve lived in our house, the biggest maintenance issue we’ve dealt with has been replacing our water heater. Some years will be less, and others will be more – possibly much more. The general rule of thumb is that you should budget roughly 1-2% of the value of your home per year for ongoing maintenance. I’m talking here about things like painting, pest control, replacing your carpet and appliances, etc. In our case, homeowners insurance runs roughly 0.2% of the value of our home per year.Īnother big issue is maintenance. You can, however, save on homeowners insurance by shopping around, increasing your deductible, etc. While you could technically drop your homeowners policy once your mortgage is paid off, you’d be a fool to do so. Once again, rates vary based on a number of factors. In fact, I’ve successfully appealed our assessment on more than one occasion. Unfortunately, the only real way to combat this bill – aside from moving to a less expensive home – is to appeal your assessment. Property taxes vary widely based on location, but around here they average about 1% of a home’s assessed value per year. So just how much do these things really cost?

We still face a number of expenses, including property taxes, routine maintenance, homeowners insurance, etc. Of course, just because we’ve paid off our mortgage doesn’t mean that we’re living for free. We haven’t regretted our decision to pay off our mortgage. The issue of whether you should pay off your mortgage early or invest has always been a hot topic in financial circles, but I can tell you this much: About a year and a half ago, we paid off our mortgage.

0 kommentar(er)

0 kommentar(er)